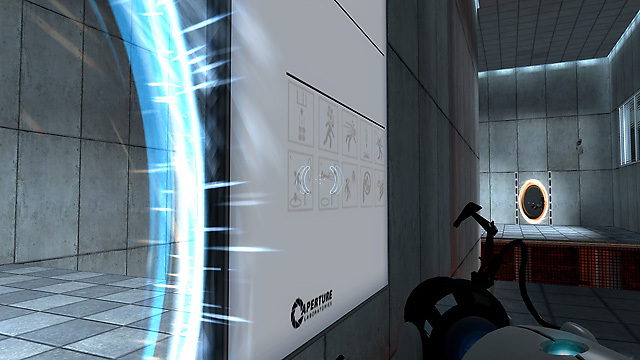

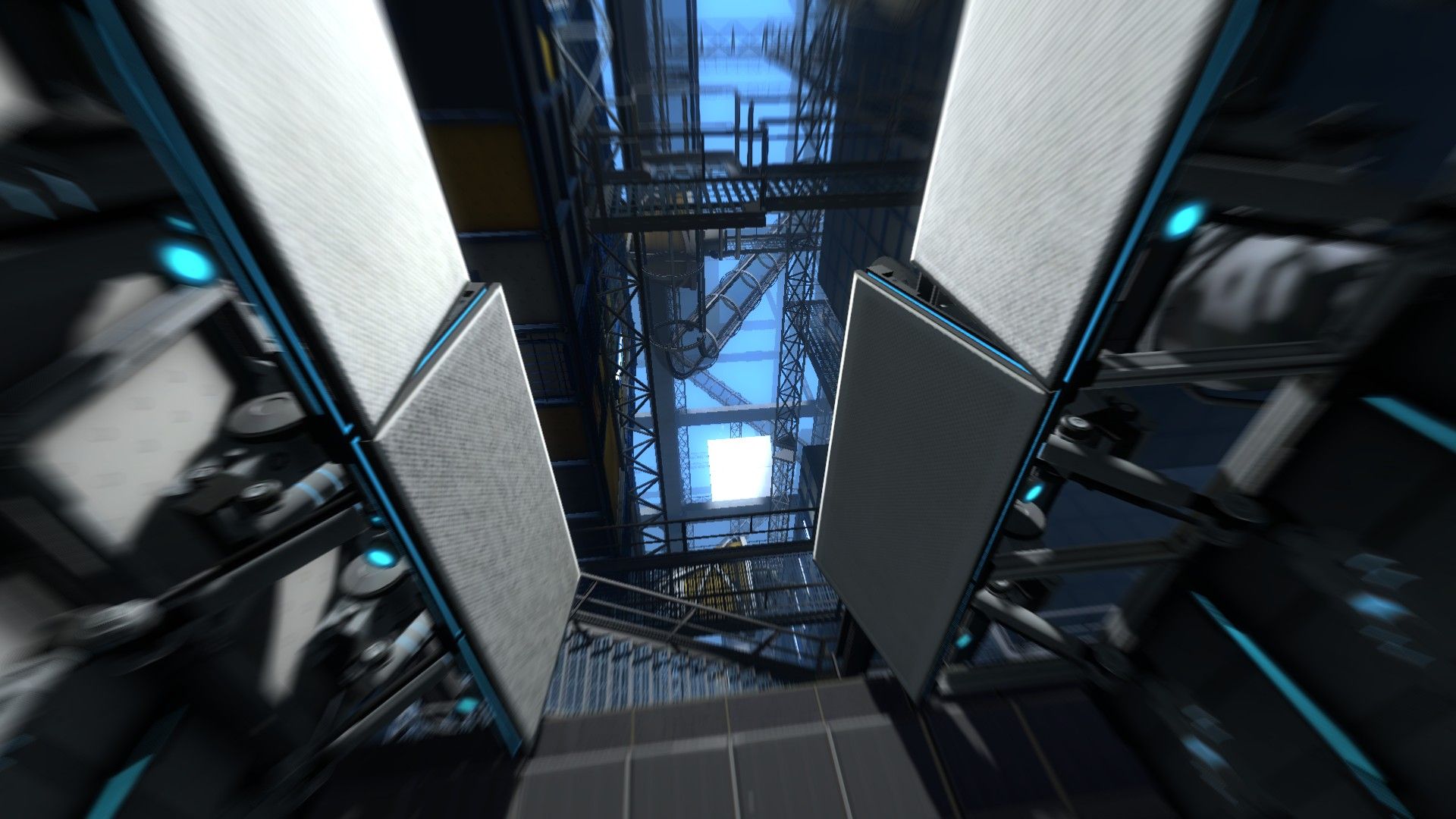

That means that you'll have to worry about things like how much weight your structure can support while also making sure vehicles driving on top avoid lasers, hit the right switches, and travel through portals safely. With all of these projects, there aren't a whole lot of resources for Portal 3, no matter how badly fans might want it.īridge Constructor Portal, for example, fuses ClockStone's engineering-based simulation game with Valve's sci-fi puzzler.

#Specs needed to play portal and portal 2 update#

The Vive is getting a substantial update sometime in 2018, and most of Valve's in-production games will be virtual reality titles (the only non-VR game that the company has announced since Dota 2 came out is Artifact, a Dota 2-themed card game). As of this writing, virtual reality is keeping Valve very busy. Most crucially, Valve collaborated with HTC to create the Vive, which some argue is the best consumer-grade virtual reality headset on the market. In 2013, the company announced SteamOS, a Linux-based operating system devoted to gaming, and a line of devices known as Steam Machines intended to bridge the gap between consoles and gaming PCs (after almost half a decade, Steam Machines are still around, although they haven't sold as well as Valve had hoped). Way back in 2000, Valve teamed with Cisco to create PowerPlay, an initiative designed to speed up consumer internet in hopes of improving online gameplay. The new income tax portal was launched on June 7.It doesn't stop there. ITR-3 is filed by people having income as profits from business/ profession, while ITR-5, 6 and 7 are filed by LLPs, businesses and trusts, respectively.

ITR-4 can be filed by individuals, HUFs and firms with total income up to Rs 50 lakh and having income from business and profession. Sahaj can be filed by an individual having income up to Rs 50 lakh and who receives income from salary, one house property/other sources (interest, etc). ITR Form 1 (Sahaj) and ITR Form 4 (Sugam) are simpler forms that cater to a large number of small and medium taxpayers. The government had in January extended till March 15 the deadline for corporates to file income tax returns for the fiscal ended March 2021, while the same for filing tax audit report and transfer pricing audit report for 2020-21 fiscal is February 15. “All taxpayers/ tax professionals who are yet to file their tax audit reports or income tax returns for AY 2021-22 are requested to file their TARs/ returns immediately to avoid the last-minute rush,” it said. The department has been issuing reminders to taxpayers through e-mails, SMS and Twitter encouraging taxpayers and chartered accountants not to wait till the last minute and file their TARs/ ITRs without further delay, the statement added. More than 1.61 lakh other tax audit reports have been filed till February 6, 2022. “Around 6.17 crore income tax returns (ITRs) and about 19 lakh major tax audit reports (TARs) have been filed on the new e-filing portal of the income tax department as on February 6, 2022,” the Central Board of Direct Taxes (CBDT) said in a statement.

0 kommentar(er)

0 kommentar(er)